Financial Analysis and Valuation for Lawyers

Law firms have many accounting details that must be addressed, and accountants must make sure everything they are processing and providing to your firm, the IRS, and other required entities is following GAAP correctly. While it is the accountant’s job to handle this the right way regardless of anything else, working with the accountant to make things easier can be very valuable for your business relationship. Some firms promote lawyers to a partner title without making them a part owner in the business. From an accounting perspective, a partner with no equity in the firm is still an employee. The standard law firm business structure is a limited liability partnership (LLP).

Best Practices in Law Firm Accounting

However, there are a couple of unique aspects to law firm accounting, and managing them can be challenging. Most notably, lawyers often hold onto funds that don’t belong to them, and specific rules govern how you need to handle that cash. It’s important to remember that a standard payment processor will keep a certain percentage of each transaction as a fee.

Mismanaging trust accounts

- Another key pillar of law firm accounting is ensuring ethical billing practices.

- So pick a payment processor that is law firm-friendly, and most certainly, rules-compliant.

- To practice law legally, attorneys must also pass the bar exam in the state where they want to work, be it for a law firm or a company.

- With the accrual accounting method, revenues and expenses are recorded when they occur, regardless of whether they were received.

- It’s important to monitor your accounts receivable (A/R) aging report to stay on top of any outstanding invoices and follow up if necessary.

By utilizing financial reports to identify opportunities, law firms can effectively manage their finances and support business growth. In most cases, law practice management software doesn’t include an accounting element specialized for law firms. This leaves you with the purchase of additional non-legal accounting software. As a result, you’re left with multiple platforms and an accounting system that is not tailored specifically for law firms.

Choosing the Right Accounting Method

Ask a CPA to help you determine which accounting method is best for your business, and stick with it. Courts will ignore this layer of legal protection if the corporate veil is pierced in any way, and one of the most common ways that business owners pierce the veil is by mixing their personal and business expenses. One reason why people incorporate their businesses in the first place is that it provides a legal separation between them and their company. Accountants sometimes call this the “corporate veil,” and it’s what protects owners and their assets from any legal action taken against the company. Recording them as anything but that could land you in hot water with regulators and mess up your taxes.

Learn How To Read the Three Key Financial Statements

Following completion, these reports are submitted to a law firm’s jurisdiction on their specified cadence. Consider what you need, and seek out accounting software that fits those needs. When setting up bank accounts for your law firm, it’s vital to ensure compliance with trust accounting regulations. Establish a separate client trust account to safeguard client funds from law firm operating funds.

FT Professional

Just be sure to choose a CPA experienced in providing law firm accounting services. Here’s what you need to know to establish and maintain an effective accounting system for your law firm. We’ll cover the unique accounting challenges lawyers face, some general best practices to follow, and the most common pitfalls you need to avoid. In addition to the above accounting principles, it’s also important for lawyers to familiarize themselves with key financial statements (i.e., reports summarizing detailed financial accounting information about your firm).

Take the time to set expectations with new clients, stick to a consistent schedule, and agree on charges in writing first. Finally, make your invoices as clear as possible, with accurate descriptions for each billed item. Meanwhile, a legal business can use the cash basis no matter their revenues, and it often represents their activities more accurately.

The advantages of legal accounting software multiply with today’s cloud-based solutions. While on-premise accounting software ties you to a physical location and requires high maintenance costs and time-consuming updates, cloud-based accounting software is accessible anywhere. Cloud-based accounting software for law firms also automatically gets updated and backed up, offering unparalleled, real-time insights into your firm’s financial data. Law firm bookkeeping records the financial transactions and balances the financial accounts for your firm. Legal bookkeeping takes place before any accounting can occur and is an essential administrative task for any law firm. Reliable bookkeeping for attorneys also provides accurate financial data for legal accountants to work with.

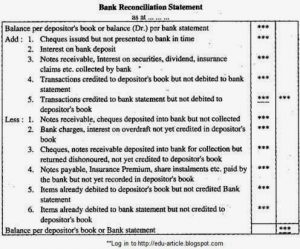

While the trust ledger includes all trust transactions across all clients, the individual client ledgers separate these transactions by client. The sum of all the client ledgers must equal the balance in the trust ledger. There should be no reconciling or outstanding items because entries in the trust ledger and client ledger should happen simultaneously. https://www.personal-accounting.org/understanding-a-balance-sheet-definition-and/ You’ll also need to pay payroll tax and ensure that your withholdings are accurate. Employment tax and law are always changing, so you must be up-to-date on workers’ compensation laws, disability and classification – among many others. Although the roles of bookkeeping and accounting are different, there is a thin line to distinguish between them.

The distinction matters because equity partners can’t earn salaries like employees. They’re taxed based on their portion of the firm’s earnings and pay themselves through an owner’s draw. Some partners also earn guaranteed payments to ensure stable income even if the business operates at a loss. Some states oblige law firms to use IOLTAs in certain situations, so check with your state bar association for rules for your firm. By leveraging these tools and expertise, law firms can effectively manage their finances while minimizing tax liabilities. This ensures that financial transactions are properly documented and tracked, minimizing the risk of errors or discrepancies in legal accounting.

Owners, called partners, enjoy the benefits of pass-through taxation under a shield that protects their personal assets from business liabilities. If the bank doesn’t waive or cover IOLTA bank service charges with interest cost of capital definition earnings, you must write a check from your business’s operating account. Accountants in law spend much of their time tracking what money the firm earned and what needs to go to clients, the courts, or third parties.

They can ensure that all client funds are appropriately allocated and tracked, preventing any potential mishandling or confusion. By accurately maintaining the chart of accounts, law firms can establish transparency and accountability in their financial dealings while protecting client trust. Bookkeeping https://www.quick-bookkeeping.net/ for law firms involves recording financial transactions and maintaining records, while accounting focuses on interpreting and analyzing those records to make strategic business decisions. When clients trust a firm with their legal issues, they also expect that their money will be handled correctly.

Accrual accounting records revenues and expenses when earned and incurred, regardless of when the money is received or paid. For example, when you send an invoice to a client, you’ll mark it as revenue, even though you might not get paid for 30 days. Just like any other business, your law firm will benefit if you follow a strict budgeting process. Set time aside every month to review your budget, and compare your forecast to your actual figures so that you can understand your performance and proactively make changes to keep your finances on track. Once again, it’s best to master the trust accounting rules well before you go into business for yourself. It’s one area you can’t afford to make mistakes because there’s rarely a chance to fix them later.